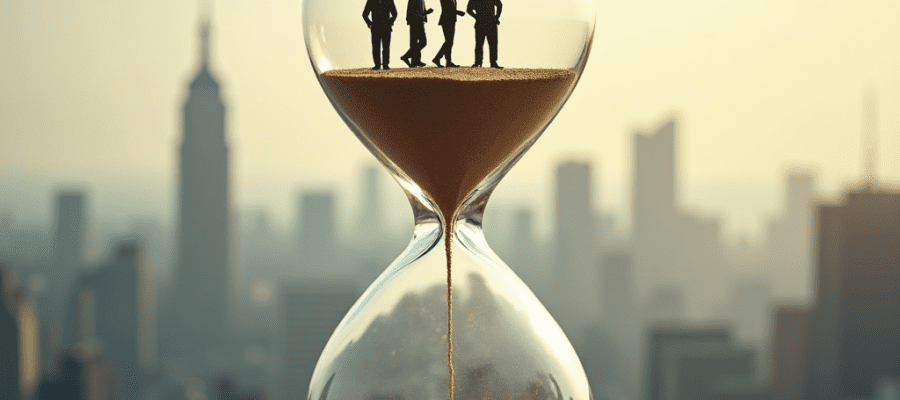

The total world population passed the 8 billion milestone in November 2022. The progression from 7 to 8 billion people took a mere 12 years, conjuring up long-standing fears associated with rapid population growth, including food shortages, rampant unemployment, the depletion of natural resources, and unchecked environmental degradation.

However, the most formidable demographic challenge facing the world is no longer rapid population growth but population aging. The world’s population is aging at an unprecedented rate, with more than 1 in 5 individuals in developed countries expected to be over 65 by 2050. This shift has profound implications for nearly all sectors of society, including labor, financial markets, the demand for goods and services, housing, transportation, and social protection, as well as family structures and intergenerational ties. As of 2024, around 17% of the U.S. population is aged 65 and over, with similar or higher proportions in other developed nations: Australia at 17%, Canada, South Korea, and the UK at 19%, France and Germany at 22%. Japan stands out, with more than 29% of its population aged 65 and above, making it one of the oldest societies globally.

Population aging, by definition, refers to the increasing median age within a population, primarily due to two key factors: declining birth rates and rising life expectancy. The global population structure has shifted significantly: life expectancy rose from 34 years in 1913 to 72 years in 2022 and is expected to keep increasing. On the contrary, since 1970, fertility rates have fallen worldwide. When the UN and WHO were founded, there were seven times more children under 15 than people over 65, but by 2050, these groups will be nearly equal. From 2000 to 2050, the global share of people aged 80 and older is projected to reach nearly 5 percent. This demographic shift results in a larger proportion of older individuals within the overall population.

These shifts indicate significant health, social, and economic challenges (and opportunities) ahead and point to the once-unlike possibility of widespread depopulation. In the coming decades, many countries are likely to face fiscal and political pressures in relation to public systems of health care, pensions, and social protections for a growing older population. Older persons are increasingly seen as contributors to development whose abilities to act for the betterment of themselves and their societies should be woven into policies and programs at all levels.

While more developed countries have completed or are well advanced in this transition, less and least developed countries (LDCs) are predominantly in the early or middle stages when the older population is still small but starting to grow. Such countries can anticipate a continuing, gradual increase in both the number and the share of older persons, many of whom will require substantial care and support at some point in their lives. Unfortunately, many LDCs are ill-prepared to offer the essential services and support that their aging populations will eventually need.

The Silver Economy: Obstacles and Opportunities

The economic consequences of an aging population in developed economies are far-reaching, impacting labor markets, fiscal policy, healthcare, consumer behavior, housing, and overall economic growth. Here’s a closer look at the main areas impacted.

Labor Market and Productivity Pressures

As the working-age population shrinks, labor shortages become a major issue. With fewer young people entering the workforce, productivity growth slows, which can stifle economic expansion. Beyond the slowdown in population growth, many developed countries are experiencing rapid aging, a trend that will intensify as the baby boomer generation continues to grow older. This creates an obstacle to labor force growth because older people often retire or work with reduced efficiency, especially past the age of 65.

Additionally, companies may face increased labor costs as they compete for a limited pool of skilled workers, which can lead to inflationary pressures and impact competitiveness.

Increased Fiscal Strain on Social Services and Pensions

Aging populations put significant strain on government budgets, especially in countries with well-developed social welfare programs, since more people are drawing on pension services, combined with fewer tax-paying workers, which increases fiscal pressure. If you’re in Europe and your parents are set to retire at 65, it’s key to note that today, 3.4 working-age individuals support each retiree. By 2050, when you might retire, this is expected to drop to just 2 per retiree. Japan is nearing this ratio now, and by mid-century, over 35 countries will face similar demographic pressures. This shift will increase the burden on workers and require both governments and individuals to rethink retirement and support systems. Governments may have to choose between raising taxes, increasing public debt, or cutting benefits—all of which have potential negative economic consequences.

A recent IMF research report highlights that in advanced economies, both private and public savings are expected to decline over the next 30 years due to increased pension spending. To ensure future retirees receive similar benefits, younger generations will need to save significantly more and delay retirement. Meanwhile, early-stage transition countries, such as those in India, Brazil, Mexico, the Philippines, and sub-Saharan Africa, must generate significant new jobs to accommodate their growing young populations, creating a stark contrast between these regions by 2050. In emerging markets and low-income developing countries, younger populations will drive higher private savings, offsetting anticipated increases in public pension spending, further emphasizing the economic divergence between aging advanced economies and youthful developing ones.

Rising Healthcare Costs

An increasing elderly population places additional strain on government budgets, not only due to pension costs but also due to higher healthcare expenditures. In the U.S., for example, analyzing healthcare spending by age-related diseases highlights how demographic shifts and disease prevalence will impact future spending, even if the cost per disease remains unchanged. Projections show a significant rise in healthcare spending driven solely by growing demand, with cardiovascular and musculoskeletal conditions expected to remain the largest areas of age-related healthcare spending.

In addition to age-related diseases, the demand for hip and knee replacements is expected to increase as populations age. In countries with public healthcare systems, this rising demand may redirect funding from other essential areas, like infrastructure or education, and add further strain on healthcare professionals and facilities.

Shift in Consumer Spending Patterns

Aging populations are reshaping consumer spending patterns, driving significant changes across sectors. Older adults allocate a higher proportion of their income to leisure, healthcare, housing, and services while reducing spending on durable goods. In the UK, individuals aged 65–74 allocate 23% of their expenditures to recreation and culture, significantly more than the 17% spent by those under 30. Similarly, in the U.S., households led by individuals aged 65 and older spend approximately 13% of their income on healthcare compared to 5% for younger households. This reflects a preference among older consumers for experiences like travel, leisure, and health, with growth in these categories outpacing younger cohorts.

Notably, the silver economy, which represents the spending power of older consumers, is growing at 3.2% annually—four times faster than the global population growth rate of 0.8%. Wealthier seniors, particularly in high-income brackets, drive discretionary spending on home improvements, gardening, and luxury travel. According to a report by the Boston Consulting Group, individuals aged 50 to 70 account for 27% of spending across nine major product categories, including big-ticket items such as vehicles, investments, and leisure travel, in 12 key markets, including the U.S. This underscores the substantial economic influence of affluent seniors within various sectors. Additionally, older consumers increasingly engage with financial services, focusing on retirement planning, annuities, and estate management. Over 60% of financial advisory clients in the U.S. are aged 60 and above, emphasizing the demand for tailored investment products. This evolving spending landscape highlights the economic influence of the silver economy, with older consumers becoming a pivotal force across healthcare, leisure, and financial sectors. Businesses that overlook this demographic risk missing out on a rapidly growing and highly lucrative market.

Financial Markets and Investment Patterns

Aging populations in developed economies are driving profound changes in financial markets and investment patterns. Research spanning 72 countries reveals that as the share of individuals aged 65 and over increases, there is a shift in investment preferences toward lower-risk, more stable income-generating assets like bonds, alongside a decline in equities. This shift could alter the dynamics in capital markets, reducing demand for equities and increasing demand for bonds and other fixed-income assets. This demographic shift, guided by the life-cycle theory of saving, predicts a 10-percentage-point decline in private saving rates and a 1–2 percentage-point annual decrease in equity returns in aging economies. Asset decumulation by retirees is also expected to exert downward pressure on asset prices, further influencing market stability.

Public finance is equally impacted, as the fiscal dependency ratio is projected to double by 2050, placing immense pressure on government budgets to fund pensions and healthcare since they may issue more bonds to fund rising deficits, increasing the supply of fixed-income securities. In Japan, for instance, households allocate 45% of their financial assets to bonds, compared to 15% in younger economies like the U.S. Additionally, the demand for bonds in Japan is expected to grow by 5–10% annually. Globally, these trends may create cross-border capital flows, with older economies seeking returns in younger, emerging markets. Policymakers and financial institutions must adapt to these dynamics, ensuring robust offerings of fixed-income products, annuities, and retirement solutions to meet the needs of aging populations while maintaining market stability.

Housing Market Implications

An aging population is set to transform housing markets in developed economies, driving shifts in demand patterns and creating new opportunities for innovation. As older adults downsize or transition to retirement communities, demand for family-sized homes is expected to decline, while interest in smaller units, senior co-living options, and assisted living facilities will rise. For instance, over 80% of the U.S. population now resides in urban areas, a significant increase from just 25% in 1870, and this trend is no longer limited to younger demographics—older adults are increasingly moving to cities. A 2017 survey revealed that 18% of those aged 80+ would prefer to move into smaller homes with age-friendly features, and 17% expressed a desire to live in senior-focused communities located in urban areas with access to city amenities. Additionally, 84% of baby boomer renters have stated they prefer renting over buying, citing lower costs and reduced maintenance responsibilities, which signals a broader shift toward rental properties among aging populations. This growing preference highlights the need for rental housing tailored to seniors, particularly in urban and suburban areas. Secondary cities, known for affordability and lifestyle benefits, are also becoming key destinations for retirees, straining existing housing stock. In 2018, New York City experienced its first population decline in over a decade, reflecting a broader trend of population growth shifting to mid-sized urban centers. This highlights the urgent need for housing developments tailored to older demographics, especially in regions where housing shortages are emerging.

Japan exemplifies the impact of aging populations on housing markets. Over 9 million abandoned homes in Japan (akiya) are causing property values to stagnate in rural areas, resulting in $24.7 billion in losses over the last five years. At the same time, Japan’s urban housing market faces growing demand from an increasingly older population, as more than 1 in 10 Japanese citizens are now aged 80 or older. In France, the aging population is projected to become the second-largest elderly demographic in Europe by 2028, driving demand for senior-friendly housing. Age-restricted housing options are a growing opportunity in France’s tenant-friendly market, as such developments are exempt from many strict housing regulations, offering flexibility for developers. In the UK, the rise of solo living among seniors is significant—seniors (aged 65+) account for 93% of the growth in solo living over the past decade, pointing to the need for housing that caters to single elderly occupants. Additionally, downsizing trends are gaining momentum in the UK, with older homeowners looking to free up capital or pass on assets, although factors like high stamp duty and a lack of suitable properties present barriers.

Furthermore, 21% of older adults expressed a preference to age in place, highlighting the importance of in-home care services and modifications to existing homes, such as adding assistive devices and enhancing mobility features. These demographic shifts also bring opportunities for innovation in real estate technology and entrepreneurship. Housing shortages in secondary cities will necessitate more efficient construction and development processes. For example, the rise of construction bidding platforms, akin to an “Airbnb for developers,” could modernize the industry, introducing features like reputation management and streamlined contracts to fill gaps in outdated systems. At the same time, the elderly, with high accumulated wealth but low and often fixed incomes, will drive demand for alternative financial instruments and partnerships to address housing affordability. As public investment slows due to fiscal constraints, private developers will play a crucial role in bridging the housing gap. The aging population, growing rapidly in developed economies, not only presents challenges but also opens avenues for transforming the real estate market with modern designs and innovative business models to meet the needs of this demographic shift.

The Path Forward

Demographic change tends to be gradual and predictable, especially when compared to more immediate and disruptive forces like pandemics, conflicts, or rapid technological advancements. This predictability provides key stakeholders with a valuable window of opportunity to implement forward-looking policies and promote behaviors that can shape future demographics and mitigate potential negative impacts. The aging population, while a reflection of the successes of development and improved living standards, brings with it a complex set of challenges—from escalating healthcare costs and pension pressures to housing shortages and labor productivity concerns.

However, these challenges also open doors to unprecedented opportunities for innovation and growth. Governments and businesses are uniquely positioned to redefine economic systems, crafting sustainable solutions that capitalize on the immense potential of the silver economy. By adopting forward-thinking policies, reimagining infrastructure, and leveraging the spending power and financial influence of aging populations, developed economies can transform this demographic shift into a driver of resilience and prosperity. The silver economy, rather than a burden, presents an opportunity to promote balanced and sustainable growth, ensuring that aging populations contribute meaningfully to economic progress and societal well-being.